Fondos

-

AXES BMV

Renta Variable Local - Indizado.

Conoce más

Inversión en ETF's y fondos

Horizonte: Largo plazo -

AXES GLO

Renta Variable Internacional.

Conoce más

Inversión en ETF´s, deudas y otros

Horizonte: Largo plazo -

AXES PRO

Especializado en valores de deuda.

Conoce más

Liquidez: 2 días

Horizonte:Corto plazo, menos de 1 año. -

AXES GSP

Renta Variable Internacional.

Conoce más

Inversión en acciones de crecimiento o valor

Horizonte: Largo plazo -

AXES V&D

Renta Variable Internacional.

Conoce más

Inversión en empresas de alta calidad con valuaciones razonables y altos dividendos

Horizonte: Largo plazo -

AXES ESG

Especializado Renta Variable.

Conoce más

Inversión en acciones de empresas de responsabilidad social.

Horizonte: Largo plazo

Fondo

gestionado por

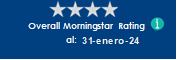

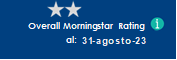

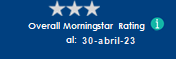

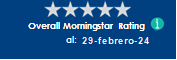

Morningstar Rating ™

El Morningstar Rating ™ para fondos, o "calificación de estrellas", se calcula para productos administrados (incluidos fondos mutuos, subcuentas de anualidad variable y vida variable, fondos negociables en bolsa, fondos cerrados, y cuentas separadas) con al menos tres años de historia. Fondos cotizados y de capital variable. Los fondos mutuos se consideran una sola población a efectos comparativos. Se calcula con base a una medida de rentabilidad ajustada al riesgo de Morningstar que tiene en cuenta la variación en el rendimiento mensual de un rendimiento excesivo, poniendo más énfasis en las variaciones a la baja y recompensando actuación. La calificación Morningstar no incluye ningún ajuste por cargas de ventas. El 10% superior de los productos de cada categoría de producto reciben 5 estrellas, el siguiente 22,5% recibe 4 estrellas, el siguiente 35% recibe 3 estrellas, el siguiente 22,5% recibe 2 estrellas y el 10% inferior recibe 1 estrella. La calificación general de Morningstar para un producto administrado se deriva de un promedio ponderado de las cifras de desempeño asociadas con sus métricas de calificación Morningstar de tres, cinco y diez años (si corresponde). Los pesos son: 100% tres años calificación para 36-59 meses de rendimiento total, 60% calificación de cinco años / 40% calificación de tres años para 60-119 meses de rendimientos totales y 50% calificación a 10 años / 30% calificación a cinco años / 20% calificación a tres años durante 120 meses o más de rendimientos totales. Si bien la fórmula de calificación general de estrellas de 10 años parece dar el mayor peso a la calificación de 10 años período de un año, el período de tres años más reciente en realidad tiene el mayor impacto porque está incluido en los tres períodos de calificación.

Distribuidores del fondo AXES EDM

Fondos de terceros distribuidos por

Avisos Importantes

Obtén información de utilidad sobre nuestros fondos de inversión y los fondos de otras operadoras.

Leer más- Copyright 2015, Derechos Reservados Finaccess México S.A. de C.V.

- Términos y Condiciones

- Mapa del Sitio